Instructions for registration in the Exness broker web terminal

Exness is a reputable online trading platform that provides access to a wide range of financial instruments. If you want to start trading with Exness, you’ll need to create an account first. Here’s a straightforward guide to help you complete your registration:

- Visit the Exness Website: Open your web browser and go to www.exness.com.

- Find the Registration Button: Look for the “Sign Up” or “Register” button, usually located in the top-right corner of the homepage.

- Select an Account Type: Click the registration button, and you’ll be asked to choose the type of trading account you want—Standard, Pro, or Cent. Take a moment to review each account’s features before deciding.

- Enter Your Email Address: Provide a valid email address that you check regularly. This email will be used to verify your account and for further communications.

- Create a Password: Choose a strong password that combines upper and lower case letters, numbers, and special characters for added security.

- Specify Your Country of Residence: Select your country of residence from the dropdown menu. This helps ensure compliance with local regulations.

- Agree to the Terms and Conditions: Read through the terms and conditions, and if you agree, check the box to indicate your acceptance. You might also need to confirm that you’re of legal trading age.

- Complete Captcha Verification: Verify that you’re not a robot by completing the captcha as instructed.

- Submit Your Registration: Once all fields are filled out, click the “Register” or “Create Account” button to proceed.

- Verify Your Email Address: Check your inbox for an email from Exness. Click the verification link in the email to activate your account. If you don’t see it, check your spam or junk folder.

- Log Into Your Account: Go back to the Exness website, click “Login,” and enter your registered email and password.

- Complete Your Profile: After logging in, you might be asked to provide additional personal information, such as your full name, date of birth, and address. Make sure everything is accurate and up to date.

- Upload Verification Documents: To meet regulatory requirements, you’ll need to upload identification documents, like a passport or driver’s license, along with proof of address (e.g., a utility bill or bank statement).

- Wait for Verification Approval: The Exness team will review your documents, which can take a few hours to a few days. You’ll get an email notification once your account is verified.

- Deposit Funds: After verification, log in and go to the deposit section. Choose your preferred payment method and add funds to your account.

- Start Trading: Now that your account is funded, you can access the Exness trading platform and begin trading. Take some time to explore its features and tools to make the most of your trading experience.

Following these steps will ensure that you successfully set up your Exness account and are ready to start trading. Always remember to trade responsibly and consider consulting with a financial advisor if necessary.

Maximum overview of the functionality of the Exness web terminal

The Exness web terminal is a powerful, intuitive, and fully online trading platform designed for traders of all levels. It combines a comprehensive suite of tools, market analysis capabilities, and seamless execution of trades, all within a user-friendly interface. Below is a detailed overview of the functionality of the Exness web terminal, covering all its major features and capabilities:

1. User Interface and Navigation

- Clean Dashboard Layout: Upon logging in, users are greeted by a clean and organized dashboard. The central part of the screen displays the main chart, with various toolbars and menus arranged around it for easy access to different functions.

- Customizable Chart View: The chart window can be adjusted to show multiple timeframes, and traders can choose between various chart types (candlestick, bar, line charts, etc.) to suit their trading style.

- Multi-Language Support: The web terminal offers multiple languages, ensuring traders from around the world can navigate the platform comfortably.

- Responsive Design: The web terminal is designed to work seamlessly across devices, including desktops, laptops, and tablets, ensuring a consistent experience regardless of the screen size.

2. Account Management

- Real and Demo Accounts: Users can easily switch between real and demo accounts. The demo account is particularly useful for new traders or those testing strategies without risking real funds.

- Multi-Currency Account Support: Traders can manage multiple trading accounts in different base currencies (USD, EUR, etc.) and easily switch between them in the terminal.

- One-Click Deposits and Withdrawals: Quick access to deposit and withdrawal options is available directly from the terminal, allowing for efficient fund management.

- Account Settings: Traders can manage personal settings, including changing the account password, leverage, and notification preferences.

3. Charting Tools

- Real-Time Price Charts: The Exness web terminal provides real-time, high-speed price data for a wide range of financial instruments, including Forex, indices, cryptocurrencies, stocks, and commodities.

- Customizable Timeframes: Users can choose from a wide range of timeframes, from the 1-minute chart to the monthly chart, allowing for both short-term and long-term analysis.

- Drawing Tools: The terminal offers a variety of drawing tools, such as trendlines, Fibonacci retracement levels, horizontal and vertical lines, and more. These tools help traders identify key market levels and patterns.

- Technical Indicators: The web terminal includes a broad selection of built-in indicators, including moving averages, Bollinger Bands, MACD, RSI, and stochastic oscillators. Traders can add, customize, and combine indicators to create comprehensive trading strategies.

- Chart Templates: Traders can save chart settings and templates, making it easier to apply a pre-configured analysis setup to different instruments.

4. Order Types and Execution

- Limit Orders (Buy Limit, Sell Limit) to execute trades when the market hits a predefined price.

- Stop Orders (Buy Stop, Sell Stop) to enter a trade at a less favorable price, often used for breakout strategies.

- One-Click Trading: For faster execution, one-click trading allows users to open and close positions with a single click, especially useful for scalpers and day traders.

- Stop Loss and Take Profit: Traders can attach stop loss and take profit levels to their orders, ensuring automatic exit from trades at pre-determined profit or loss levels.

- Trailing Stop: A dynamic stop loss feature that moves with the price to lock in profits as the market moves favorably.

5. Risk Management Tools

- Margin and Leverage Management: Traders can manage the leverage on their account from within the terminal. Exness offers flexible leverage options, allowing traders to adjust risk exposure.

- Risk Alerts: Customizable risk management alerts notify users when their margin level is approaching a critical level, helping to avoid margin calls.

- Trading Volume Control: Traders can easily manage the size of their positions and set lot sizes to control risk.

- Balance and Equity Tracking: Real-time updates on account balance, equity, margin, and free margin ensure traders are always aware of their account health.

6. Comprehensive Market Access

- Wide Range of Instruments: The Exness web terminal provides access to multiple asset classes:

- Forex: Over 100 currency pairs, including majors, minors, and exotics.

- Cryptocurrencies: Popular cryptos like Bitcoin, Ethereum, Ripple, and Litecoin.

- Commodities: Gold, silver, oil, and other metals and energies.

- Indices: Major global indices, such as the S&P 500, FTSE 100, and Nikkei 225.

- Stocks: A large range of individual stocks from top global companies.

- Instrument Specifications: Users can view detailed specifications for each instrument, including spreads, margin requirements, and trading hours.

7. Trading Signals and Market Analysis

- Integrated News Feed: A live market news feed, powered by leading financial news sources, provides updates on economic events, geopolitical developments, and other market-moving news.

- Economic Calendar: The web terminal includes an economic calendar, displaying key upcoming economic releases and events that may impact the markets.

- Trading Signals: Traders can receive built-in technical analysis signals, offering buy/sell recommendations based on predefined technical setups.

- Sentiment Analysis: Real-time sentiment tools show the percentage of traders currently buying or selling a specific instrument, helping traders gauge market sentiment.

8. Trading History and Performance Analysis

- Order History: Traders can view a detailed history of all executed orders, including entry and exit points, profit/loss, and any applied stop loss/take profit levels.

- Performance Reports: Users can generate detailed performance reports to analyze their trading activity over a specified period. This helps in assessing the effectiveness of different trading strategies.

- Exportable Data: Trading history and performance data can be exported to CSV files for further analysis in external programs like Excel or Google Sheets.

9. Security and Support

- SSL Encryption: The Exness web terminal uses advanced SSL encryption to ensure secure transmission of sensitive data.

- 2-Factor Authentication: For added security, traders can enable 2-factor authentication (2FA) to protect their accounts.

- Support and Help Center: The platform includes access to an extensive help center with guides, FAQs, and tutorials. Additionally, traders can reach out to the Exness support team directly from the terminal via live chat or email.

10. Compatibility and Accessibility

- Browser-Based Platform: Since the Exness web terminal is fully browser-based, there’s no need to download or install any software. It is compatible with all major browsers, including Chrome, Firefox, Edge, and Safari.

- Cross-Platform Syncing: Traders can start a session on one device and continue on another seamlessly, as all settings, charts, and open trades are synced across devices in real-time.

- No Download Required: The web terminal runs entirely online, making it accessible from any device with an internet connection, ensuring maximum flexibility for traders on the move.

The Exness web terminal is a highly versatile and feature-rich platform that caters to both beginner and advanced traders. With its real-time market data, advanced charting tools, robust order execution, and comprehensive account management features, it provides everything a trader needs to succeed in the markets. The terminal’s ease of use, combined with its deep functionality, makes it a top choice for traders seeking a reliable and efficient trading platform.

How to start trading in the Exness web terminal

To begin trading on the Exness web terminal, the first step is to create an Exness account. Head over to the Exness website, where you’ll need to sign up using your email address and set up a password. After registering, you’ll be prompted to verify your email. Once the verification is done, log in to your new account and finish the registration process by providing your personal details, such as your name, country of residence, and phone number. Depending on your location, you may also have to verify your identity by submitting relevant documents, like a passport or national ID.

Once your account is set up and fully verified, it’s time to deposit funds. Exness supports various payment methods, including bank transfers, credit cards, and e-wallets. Pick the method that suits you best, deposit the required amount, and wait for the funds to show up in your account. Keep in mind that the minimum deposit can vary depending on the type of account you’ve selected.

With your funds in place, you’re ready to access the trading platform. Click on the “Web Terminal” option in your Exness dashboard to start trading directly through your browser—no software download needed. The terminal interface is equipped with numerous features designed to support your trading activities, such as advanced charts, technical analysis tools, and an order execution panel.

Before making any trades, it’s a good idea to get familiar with the available trading instruments. Exness offers access to a broad spectrum of markets, including forex, cryptocurrencies, commodities, indices, and stocks. You can browse through the list of assets on the platform and monitor their real-time prices.

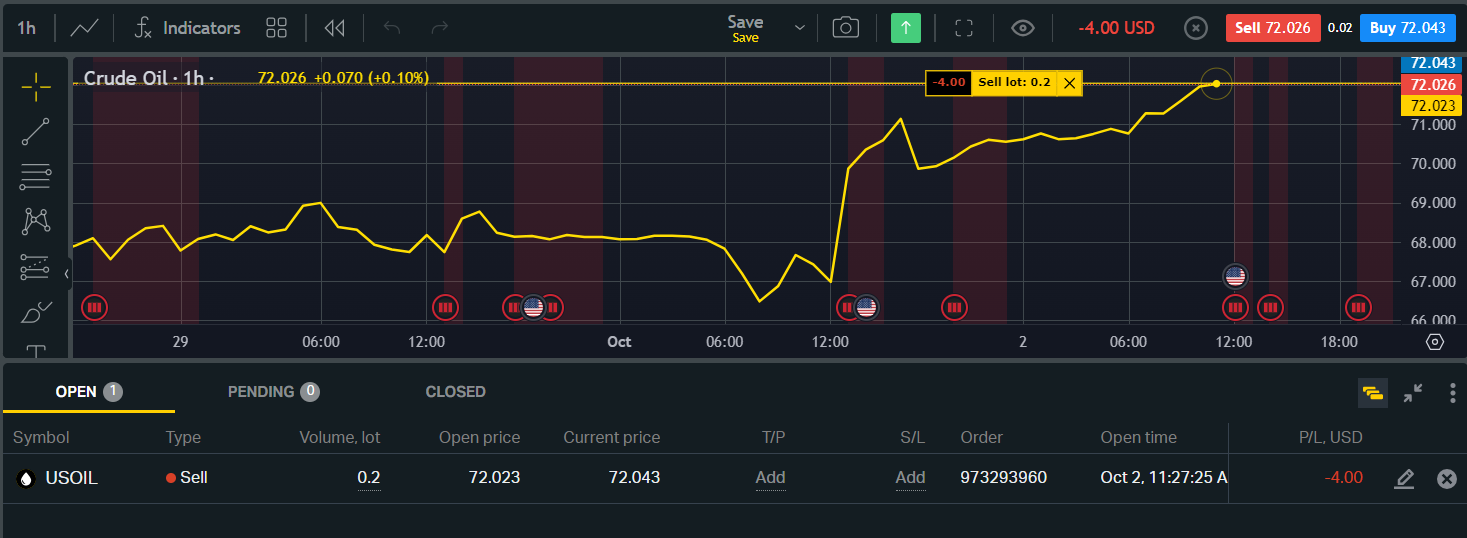

When you’re ready to place a trade, choose the asset you want to trade. Decide whether you want to go long (buy) or short (sell) based on your market analysis. Set the trade size on the order panel, which, depending on the asset type, might be measured in lots (forex) or units (stocks and commodities). You can also configure stop-loss and take-profit levels, which help you manage risk and protect your account from excessive losses.

Once you’ve finalized the trade parameters, click the “Buy” or “Sell” button to execute the trade. The position will now be active, and you can monitor its progress on the web terminal’s interface. To aid your trading decisions, you can also utilize various analytical tools such as trend lines, moving averages, and other indicators provided by the platform.

If you want to close a trade at any point, go to the “Open Trades” section in the web terminal. Click on the trade you wish to close and select the “Close” option. Your profit or loss will be automatically reflected in your account balance.

As you continue trading, keep an eye on your margin and leverage levels. Exness offers leveraged trading, allowing you to control larger positions with a smaller initial deposit. While this can amplify your profits, it also increases risk. If the market moves against you and your margin level drops too low, you may receive a margin call or have your trades closed automatically by the platform.

FAQ

1. What is the Exness web terminal?

The Exness web terminal is a browser-based trading platform that allows you to trade without downloading or installing any software. It provides access to various financial instruments, including forex, commodities, and cryptocurrencies.